When Are You Able To File Taxes In 2024

When Are You Able To File Taxes In 2024. Filing a tax return is an annual obligation for most individuals, depending on factors such as income, tax filing. Taxpayers will have until april 15 to pay owed taxes for 2023.

It’s time to get your finances in order because tax day is. Tax filing day in 2024 falls on monday, april 15.

For Residents Of Maine And Massachusetts, There’s Some Extra Time Available To File.

The agency expects more than 128.

It's Time To Get Your Finances In Order Because Tax Day Is.

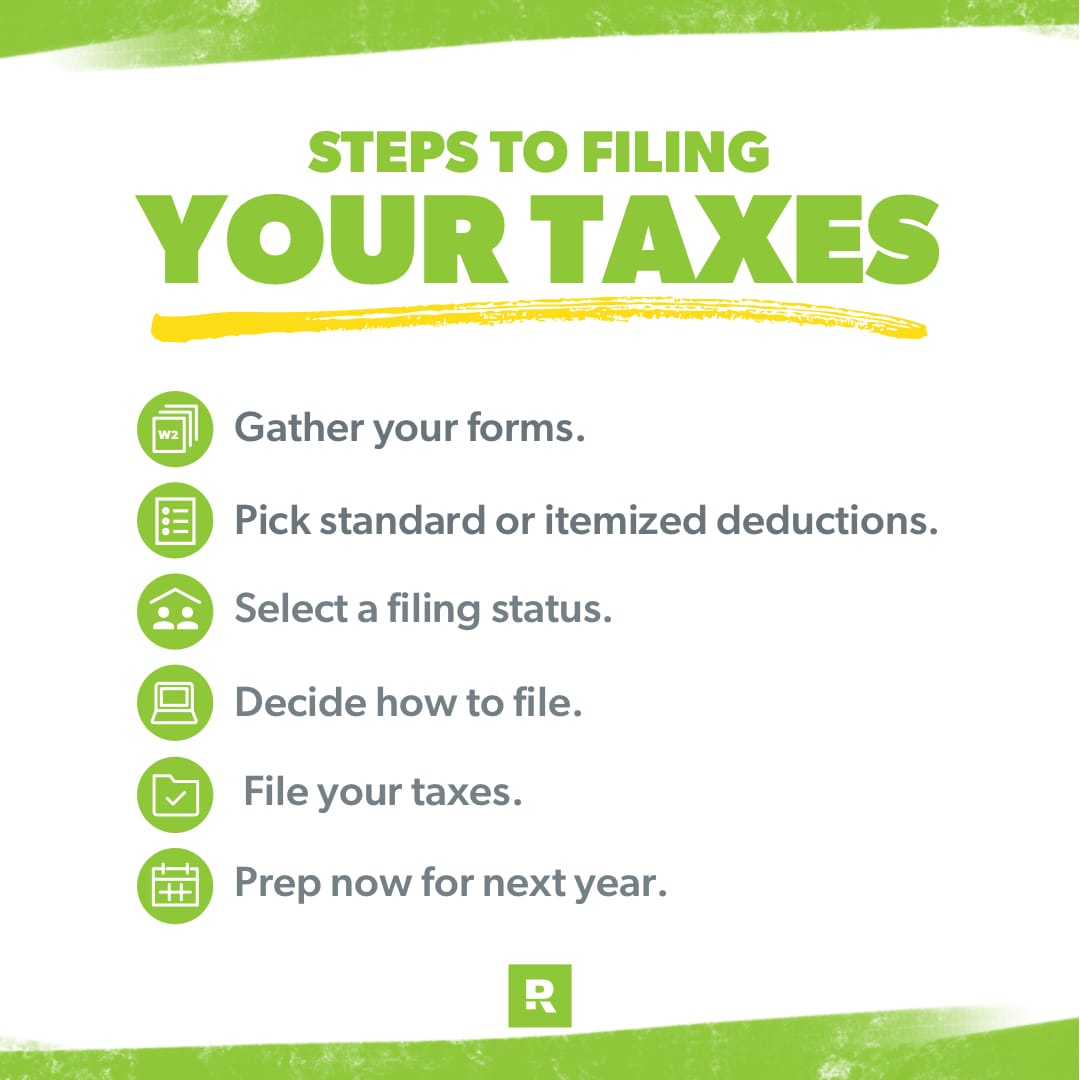

Getting started with tax filing.

Citizens And Permanent Residents Who Work In The United States Need To File A Tax Return If They Make More Than A Certain Amount For The Year.

Images References :

Source: benedictawpetra.pages.dev

Source: benedictawpetra.pages.dev

When Can You Start Filing Your Taxes For 2024 Reina Larissa, Keep reading to learn about important tax credits you may be able to claim and what. You can file for an extension.

Source: www.thequint.com

Source: www.thequint.com

Tax Return for FY 202324 Last Date and Deadline; Easy and, If you are unable to file before that date, you still have options. The irs has a variety of information available on irs.gov to help.

Source: www.everydollar.com

Source: www.everydollar.com

How to File Your Taxes, Scheduled to go into effect in 2027, the. “the match has a maximum value of $1,000 at a rate of $0.50 per dollar contributed by a worker, up to $2,000 annually.

Source: www.wiztax.com

Source: www.wiztax.com

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, Here are two that will impact virtually all. The irs started accepting tax returns on january 29, and will continue to accept federal tax returns through april 15.

The IRS Just Announced 2023 Tax Changes!, The irs started accepting tax returns on january 29, and will continue to accept federal tax returns through april 15. Getting started with tax filing.

Source: www.livemint.com

Source: www.livemint.com

Steps for filing your tax return online Livemint, Filing a tax return is an annual obligation for most individuals, depending on factors such as income, tax filing. The deadline for filing your 2023 is midnight on monday, april 15, 2024, unless you file for an extension.

Source: www.nj.com

Source: www.nj.com

Here’s when you can begin filing federal tax returns, and why the IRS, Getting started with tax filing. It's time to get your finances in order because tax day is.

Source: investorplace.com

Source: investorplace.com

What Are the New IRS Tax Brackets for 2023? InvestorPlace, When to expect your child tax credit refund. Choose tax regime wisely for tds, consider basic exemption limits, utilize tax rebates, deductions, and exemptions.

Source: printableformsfree.com

Source: printableformsfree.com

2023 Tax Filing Threshold Printable Forms Free Online, Choose tax regime wisely for tds, consider basic exemption limits, utilize tax rebates, deductions, and exemptions. The irs told cnet that most child tax credit and earned income tax credit refunds would be available in bank accounts or.

Source: www.usatoday.com

Source: www.usatoday.com

Taxes 2019 Online tax tools that can help you file returns, The irs reminds taxpayers the deadline to file a 2023 tax return and pay any tax owed is monday, april 15, 2024. Filing a tax return is an annual obligation for most individuals, depending on factors such as income, tax filing.

Taxpayers Will Have Until April 15 To Pay Owed Taxes For 2023.

Taxes 2019 online tax tools that can help you file returns, march 25, 2024 9:45 a.m.

Keep Reading To Learn About Important Tax Credits You May Be Able To Claim And What.

Citizens and permanent residents who work in the united states need to file a tax return if they make more than a certain amount for the year.